I have recently had the pleasure of supporting the work of Coloradan Candice Smith, Executive Director of Boss Generation, Inc., which serves to provide scholarships to women from Colorado and provide subsequent financial literacy support to scholarship recipients.

In its inaugural year, women attending colleges shared their stories of how the pandemic had impacted their families financially and how college expenses add to that crunch. Boss Generation, Inc., is working to help college students with financial planning resources and other educational supports to decrease the amount of debt they accrue during college.

Candice cites abundant data that shows that pursuing college is such a financial challenge for so many women of color, but that providing educational methods of understanding the basics to better financial planning is far and few between. When schools don’t provide, it is non-profit and other community organizations trying to tackle that task.

Colorado legislators are taking the first steps to this need. HB21-1200,“Revise Student Financial Literacy Standards” is a bill that directs the Colorado State Board of Education to “review standards relating to the knowledge and skills that a student should acquire in school to ensure that the financial literacy standards for ninth through twelfth grade.”

This would include management of debt such as student educational expenses and loan acquisition, credit card debt, homeownership and mortgage debt, as well as preparing for retirement plans, including investment options and retirement benefits.

The Denver Metro Chamber of Commerce recently backed this bill, which also includes additional funds for resources that the Colorado Department of Education houses for financial literacy courses offered by schools and educational non-profit organizations.

The problem is that so many people are not given that information freely while attending school. Personally, I was one of those people who only learned money management informally which consisted of my grandmother (who lived to be 101 years old) emphasizing three rules I needed to follow: Never ruin my credit, save as much money as I could, and be sure to have a pension, insurance and other investments as a way to pay for a long life after retirement.

She modeled all of these rules herself throughout her life through methods probably definitively practiced by those of the silent generation who believe it or not performed economically better then than my generation is faring now. For countless secondary students and young adults, we are never taught explicitly in school how to actually do any of what my grandmother suggested to me as a way to close economic inequalities.

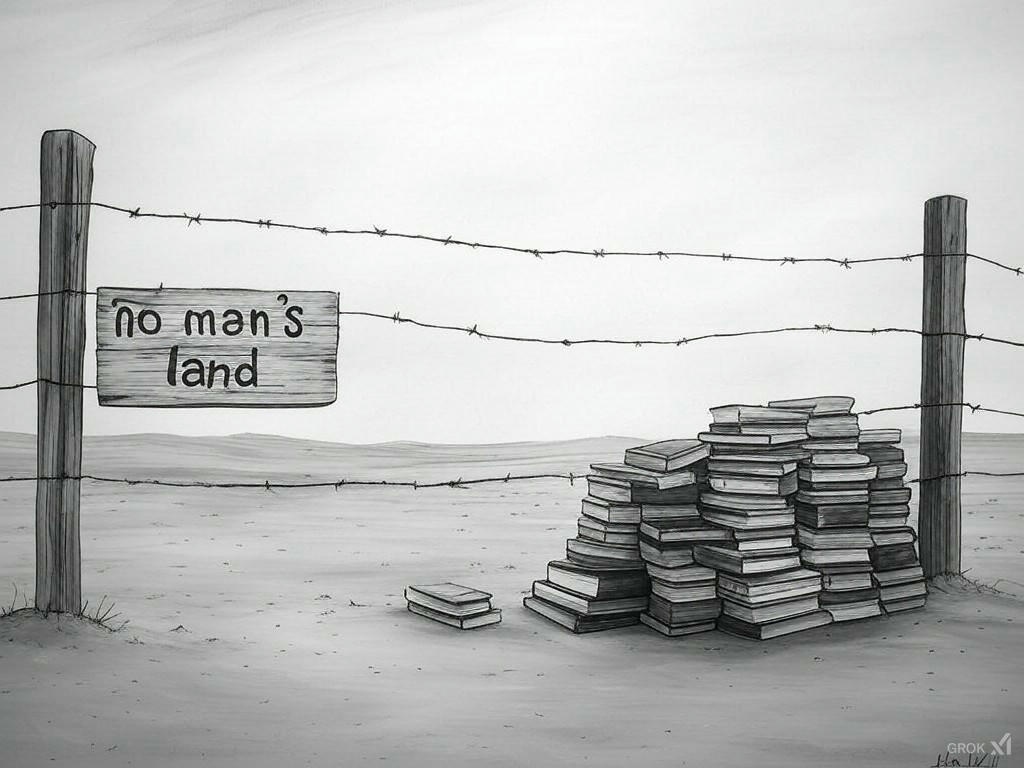

In the past decade, researchers have found that far too few students receive personal finance education at any time during their formal schooling. Immediately upon graduating from high schools, these students are expected to make big decisions about student loans, credit card spending, and budgeting for living expenses.

Many end up making financial decisions with no guidance or support. From taxes to banking to using credit to managing retirement, this information is critical to survival in America. Layered on this lack of guidance for students of color in particular are economic inequalities created by racist policies dating back at least to the Roosevelt administration.

A prime example is the Federal Housing Administration’s tactics during the Great Depression that spearheaded redlining, discrimination in lending, and unfair ways of preventing people of color from attaining wealth through home equity.

It is imperative that school districts and state legislators not only provide personal finance and financial literacy standards, classes, and resources, but also make these courses a graduation requirement.

The evidence for this need is overwhelming. In a 2017 survey conducted by the Federal Reserve, 40 percent of adults reported they would be unable to cover an unexpected $400 expense without selling something or borrowing money.

Yet school systems have been slow to address the needs of students and their families. A 2017 state report card from Champlain College’s Center for Financial Literacy found only five states required a one-semester course on personal finance as a graduation requirement.

Current research has correlated financial literacy education in high school to positive financial health outcomes later in life. In a 2018 study of the financial health outcomes for a diverse set of 18 to 22-year-olds who were required to take some form of financial literacy in high school, that research found that overall that group of students had better credit scores than students who hadn’t taken courses.

Unfortunately, the bill under consideration in the state legislature does not include a course requirement for all Colorado high schools. Under current state law, “school districts are encouraged (but not required) to adopt a financial literacy curriculum and to make completion of a course in financial literacy a graduation requirement.”

School districts and charter networks should not be allowed to continue to choose if these courses should be offered to all students; state legislators should make such classes mandatory.

To continue the current, flawed approach means maintaining economic inequities. All students, but especially students of color and those not classified as having “high” social-economic status, need and deserve access to financial literacy courses.

In fact, the lack of research on which schools provide financial literacy courses in Colorado begs the question of which demographics of students are even receiving these courses as graduation requirements and if there are instead racial disparities in this “optional” access.

This should be a huge concern for parents sending their students to public and charter schools in Colorado.

As the economy continues to be hobbled by the coronavirus pandemic, students are preparing to enter a world where high unemployment, bankruptcy, housing loss, and other financial hardships will have lasting effects. Schools must be charged with providing equitable access to personal finance education because understanding how to build wealth will be one of the most important services schools can offer the communities they serve.

It is commendable that managing debt will be added to curriculum resources, but the next step is to stop making these courses optional for Colorado school districts and networks.